How Dynamic Route Optimization Transforms Delivery

Whether you’re a seasoned fleet manager or a newbie trucker, you’re sure to have experienced some form of disruption en route to making a delivery. From minor changes to traffic patterns to full-scale problems caused by poor weather conditions, unplanned delays can cause havoc to delivery operations.

Yet, tight delivery schedules do not need to be left to chance by solely relying on static route planning. Instead, dynamic route optimization is the practice of continuously changing vehicle routes in real time based on evolving conditions and disruptions to meet KPIs [link to last mile delivery metrics blog]. And with technology making dynamic routes easier and easier to plan, there’s no reason businesses in today’s logistics and transportation industry should be missing out on the benefits.

What is Dynamic Route Optimization?

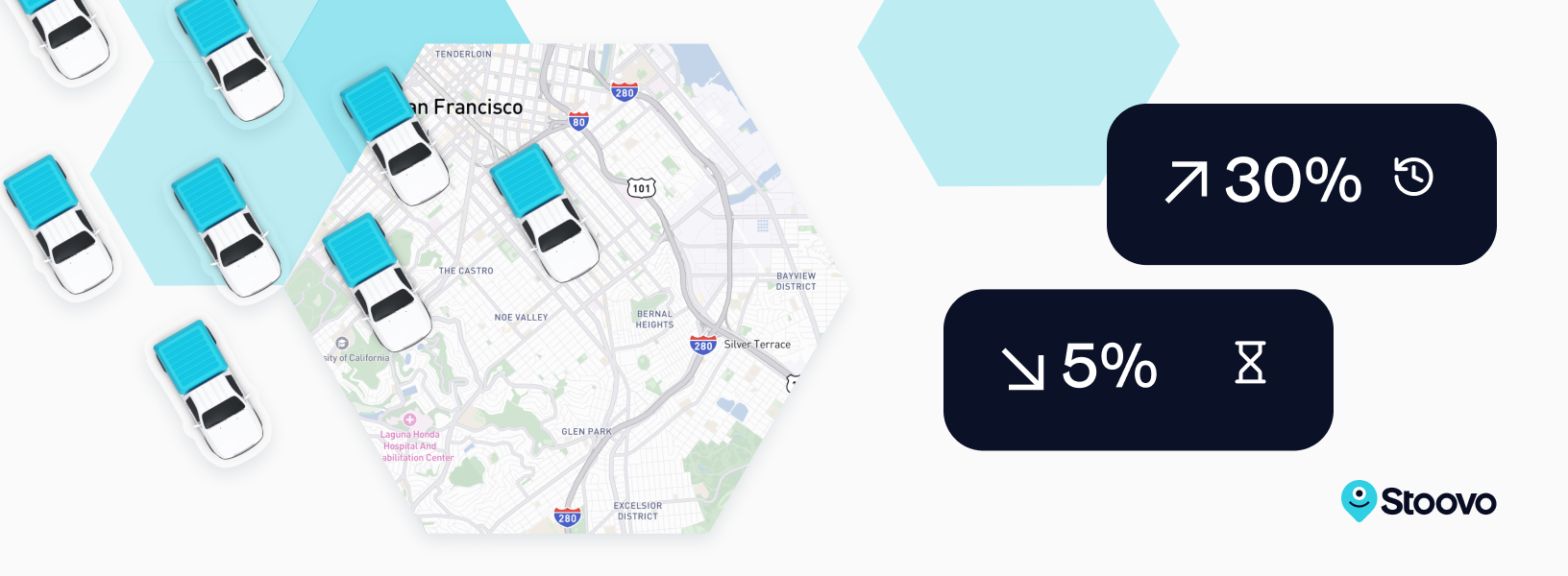

Dynamic route optimization is a fleet management practice that constantly makes route adjustments based on real-time data. Whereas traditional route planning would simply mean mapping a predefined route from A to B using a map, dynamic route optimization uses complex software to monitor evolving factors, such as traffic patterns, weather conditions, idle time, historical data, and more, to find the best route possible in real-time.

By relying on dynamic route optimization systems, fleet managers can optimize fuel consumption and minimize delivery delays, saving costs and reaching close to maximum efficiency from drivers and vehicles – even in the last mile delivery process [link to the Last Mile Delivery Problem blog].

Benefits of Dynamic Route Optimization

Although static routing has been the go-to for generations of delivery drivers and dynamic route optimization software can be expensive, dynamic route planning is fast becoming the industry standard, and the benefits clearly show why.

Dynamic routes are:

- Cost Efficient – Firstly, dynamic route planning dramatically increases cost savings. Optimizing delivery routes helps fleet managers save fuel costs, slashes costly driver idle times, and reduces delivery errors. Moreover, dynamic route optimization reduces vehicle wear and tear and maintenance, reducing vehicle maintenance costs per delivery.

- Time-Saving – Faster deliveries and reduced idle times mean fewer empty miles and more timely deliveries. Dynamic routes reduce inefficiencies as they crop up en route, meaning more timely deliveries and fewer wasted hours in traffic!

- Cleaner and Greener – Dynamic route planning reduces truck miles needed per delivery, meaning each delivery is cleaner and greener than before. With a reduction in a fleet’s carbon footprint due to more efficient routes and fuel use, dynamic route optimization means cleaner air, fewer carbon emissions, and a better environmental impact than ever.

- Better for Customer Satisfaction – Last but not least, dynamic route optimization means happier customers. With predictable delivery times and real-time updates when a package is delayed, customers need to wait around less and are in the know at all times. That means higher customer satisfaction and more chance of repeat customers!

Real-world Applications of Dynamic Route Planning

So, with all these benefits, it’s no surprise that industries everywhere are harnessing the power of dynamic routing to improve their delivery targets. But what industries are set to benefit the most?

The apparent winner of dynamic route planning software is e-commerce companies. Major players like Amazon rely on dynamic route planning and optimization tools to find the best routes and give customers faster delivery and service times. Customers can tap into the routing software data, get live delivery status, and track their purchase from the warehouse to their front door. Finally, ecommerce platforms benefit from lower costs, higher margins, and increased labor efficiency.

The benefits of dynamic routing extend down the supply chain. Wholesale delivery operations optimize routes and ensure that raw materials and key goods are delivered on time when they’re needed while slashing costs and carbon emissions. The entire logistics industry is streamlined by using fleet management software effectively, from delivery to pick-up.

But it’s not just the ecommerce and delivery giants that stand to benefit. An often overlooked real-world example of dynamic route optimization work in action is the emergency services we rely on daily. For services such as ambulances, police cars, and fire trucks, finding the optimal routes could mean getting to a location in time or being too late. Operators can use dynamic routing software to avoid traffic, get around disruption, and save more lives.

And finally, these benefits are passed on to us, the individual consumer as well. Not only does the most efficient route mean we get our food and products delivered to our homes much faster, but we also benefit from cost savings and fewer traffic jams. Effective route planning and optimization mean that those congested streets see less commercial traffic in busier time windows, meaning we can save time on our usual commute.

The Challenges and Considerations of Dynamic Route Planning

The benefits are clear, but what are some of the pitfalls of this innovative technology?

The main advantage of dynamic routing is its ability to happen in real-time, but the routes the software generates are only as good as the information that the software receives. There must be active, up-to-date, and accurate data for effective optimization. When data is incorrect or misleading, the software cannot generate the most efficient routes at all and may, in fact, cause more problems. This means sourcing information about unexpected road closures, traffic jams in real-time, live road conditions, and weather conditions. In times of crisis where communication networks are down (during a storm, for example, or in remote areas), this might mean that dynamic route optimization software is limited in its effectiveness.

In addition, dynamic routing software is great when it can integrate efficiently with the day-to-day software fleet managers and delivery drivers rely on. Yet integration can be complex and challenging. Firms may have experienced challenging past experiences with software implementation or hardware that supports on-road performance, and communication can be expensive, limiting the effectiveness of dynamic routing.

Finally, it can be a steep learning curve for drivers and fleet managers to switch from static routing to dynamic delivery management. Often, the introduction of new software means undergoing extensive (and expensive) training processes and adapting to a change management timeline before a business can see results. Older staff members may find it more challenging to adapt to using new dynamic route optimization software in their day-to-day, and attitudes to innovation must be carefully managed should a business wish to see the full benefits from the implementation.

Future Trends in the Industry

Despite the drawbacks, this dynamic technology using real-world data is here to stay. The future delivery process may look different from the ones we rely on today, and the biggest shift will certainly come from the increase in data and software.

One key trend we predict is the increasing integration of route optimization software with AI and machine learning. The future of dynamic routing may mean that it is a robot that finds and allocates the best route, not a human fleet manager. In fact, the future may mean fully automated delivery processes reliant on drone technologies and autonomous vehicles.

While the robot future may be speculation, what’s undoubted is the change towards greener and even more efficient routing in line with environmental targets and a shift towards net zero. As the planet warms and fuel prices soar, there will be legislative, economic, and consumer-based pressures to reduce fuel costs and optimize distance traveled.

Final Thoughts

The importance of dynamic route optimization in modern logistics means that this technology is here to stay. From delivery routes to emergency services response time, dynamic routing software is changing how we travel, interact with others, and receive deliveries. From finding the most efficient routes to slashing fuel costs, dynamic routing software brings a whole host of benefits to businesses and consumers alike.

If your business relies on any form of delivery route or fleet management process, it’s critical to consider the implementation of reliable dynamic routing software in your workflow. From reducing costs to optimizing working time, reducing your carbon footprint to improving customer satisfaction, dynamic routing software is a crucial element of improving efficiency that simply cannot be overlooked.

FAQs

What are key performance measures for delivery operations?

While KPIs may vary, common performance measures for delivery operations include metrics and analytical tools such as service time, on-time deliveries, delivery accuracy, route optimization efficiency, fuel consumption, last-mile deliveries, idle time, vehicle utilization, and customer satisfaction ratings.

Can dynamic route optimization be used in industries beyond transportation?

Absolutely! One of the main advantages of dynamic route optimization is the versatility of this type of software. Dynamic route planning software can be used effectively in many industries, including logistics, in-field services, emergency response, and more. Dynamic routing, as opposed to static route planning, is critical in any industry where the movement of goods and efficient resource allocation is important.

What is the difference between static routes and dynamic routing?

Whereas static routes are routes set in advance and remain constant no matter the circumstances, dynamic routing means adjusting routes in real-time based on factors like traffic, weather, driver availability, and road closures for optimal efficiency and cost-effectiveness.